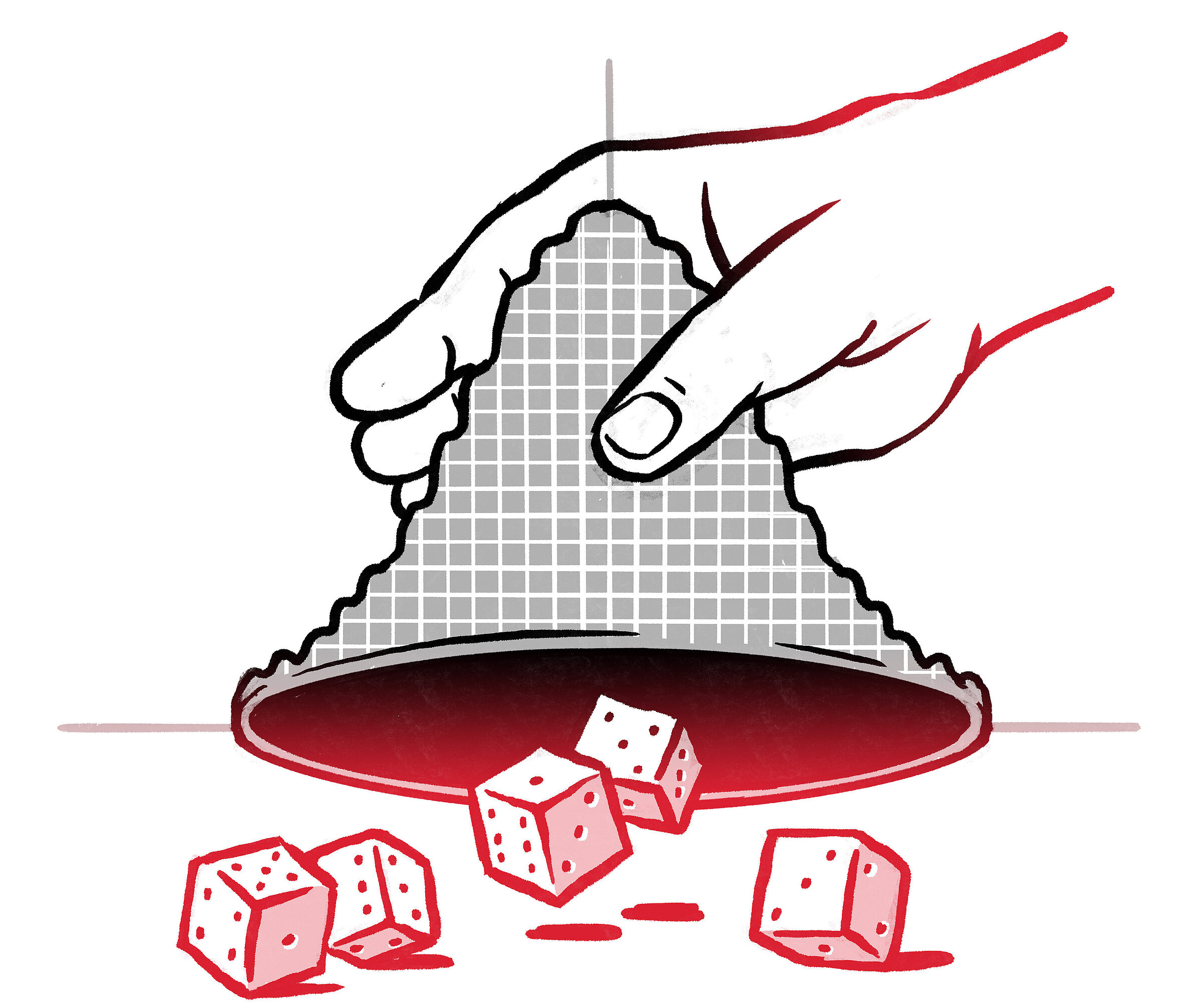

Stochastic analysis is fundamental to the mathematics of finance. Basically, it’s the same thing as probability theory, which originated in gambling and betting and has a bad reputation. But the mathematics behind it is wonderful. Let’s take flipping a coin: I win or lose one euro with each flip of the coin and the longer I play, the more I win or lose. If I win 10,000 times, I have 10,000 euros. However, scenarios like this are extremely rare. Typical behavior is not 10,000 but its square root, i.e. in the region of minus 100 to 100. With every flip, the probability distribution moves closer to a Gaussian bell curve.

This function is fascinating because it would also exist on another planet. It’s a universal object. If I replace coin flips with particles, I get Brownian motion – something that aliens on another planet would also be familiar with. This is one of the fascinating things about mathematics – finding objects that simply exist.

Mathematics has never been able or willing to decide whether it belongs with philosophy or with the natural sciences. This constant balancing act is also its strength because it’s not tied to one particular application. At the heart of mathematical problems there are always ideas, objects, and constructs that can be transposed to other fields. The better the mathematics, the more transferable it is.

A key area of my work is the rough paths theory from numerical stochastics. This is a theory of objects that come with a time parameter and model a particle that moves over time. The motion path of this particle is called a rough path, as seen in Brownian motion or in the jagged chart of a stock market index.

Take a look at a burning sheet of paper. If we set fire to one side, we can see how the fire eats its way into the paper. If we were to light 10,000 sheets one after the other, it would look subtly different each time, as with flipping a coin. This roughness prevents classical analysis. Itô calculus, one of the great mathematical success stories of the 20th century, succeeded in modeling this to some extent. But it’s based on probability theory and you can’t point to it with your finger and say, “That’s how it is!” The new rough paths calculus enables us to do exactly that. This is the perspective that has been missing until now, and Berlin has played a leading international role in developing it.

Rough paths are one of the most promising fields of mathematics. They combine stochastics with analysis, algebra, and geometry. Bringing together so many fields has led to an explosion of possibilities. It’s like seeing Aladdin’s cave opening in front of our eyes.

I’m attempting to optimize the fundamental principles and methods for applications. Among other things, we have contributed research on rough volatility to improve models for valuing options on the financial market. Options are not just speculation tools. They’re also used to hedge against risks such as fluctuating exchange rates. But we can also consider financial mathematics in isolation, detached from any kind of application. It’s the same mathematics that enables us to obtain fundamental insights in physics.

Like gambling, the financial markets don’t always enjoy the best reputation. Yet they’re essential for the prosperity of our society. It’s precisely for this reason that we need a critical understanding of the underlying mathematical models. And the more people understand them, the better armed we will be against misuse and future crises.